scope

Background and the Problem Scope

The airport’s luggage handling system has an essential role in keeping passengers pleased,

which is a critical component in the ability of an airport to attract or retain a significant airline

hub (Nice, 2001). SITA is the world’s leading specialist in air transport communications and information

technology. Currently, SITA is serving 95% of international destinations, including collaboration with

over 2.500 airlines, airports, ground handlers, and governments (SITA, 2021). This means that SITA's

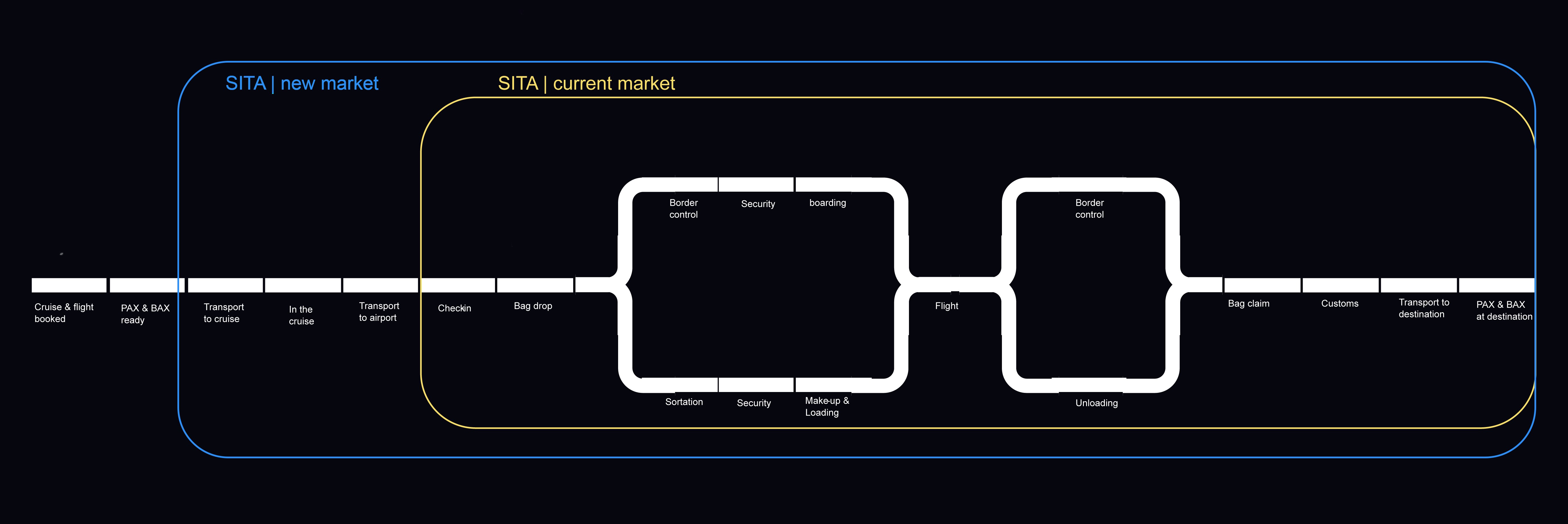

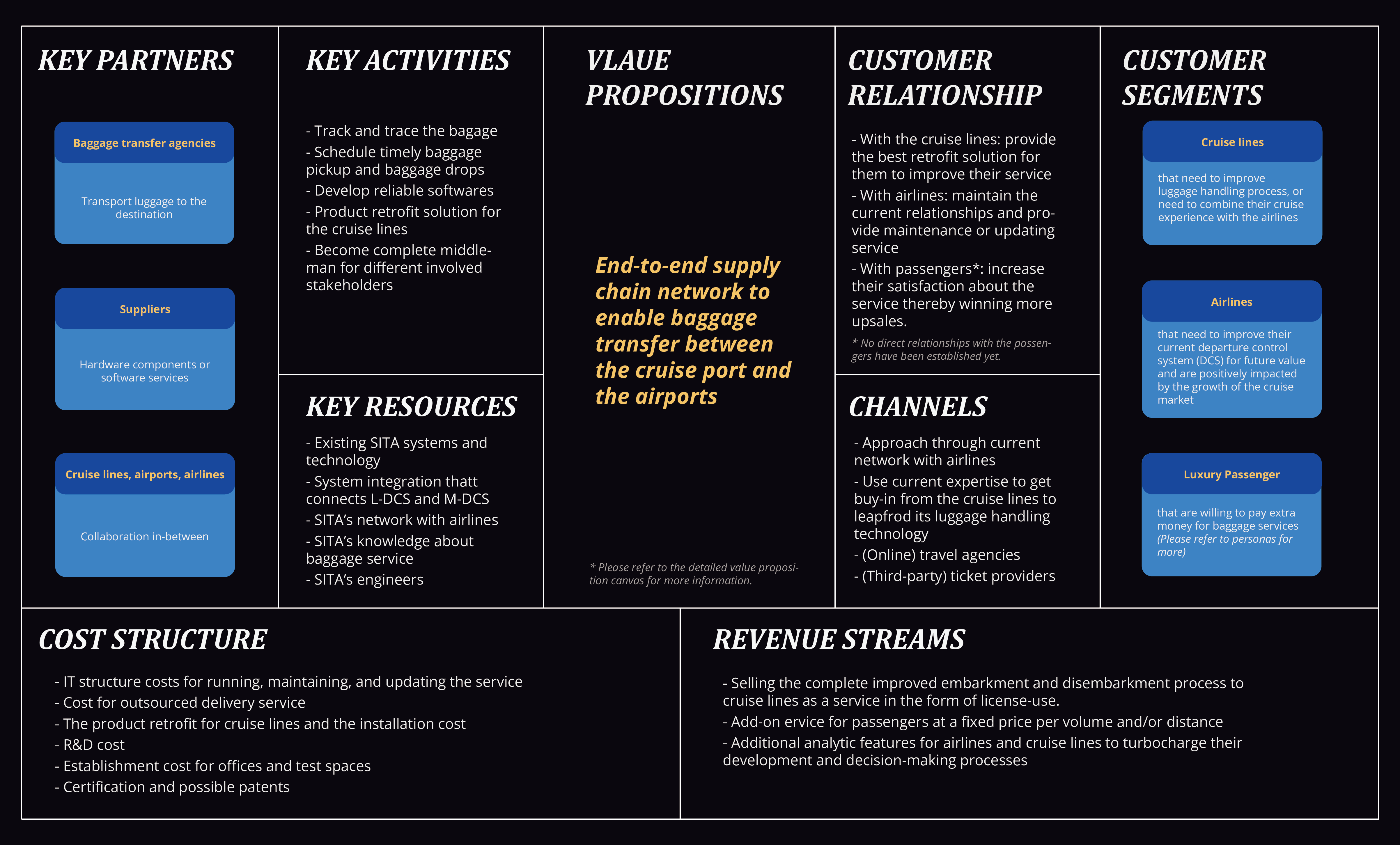

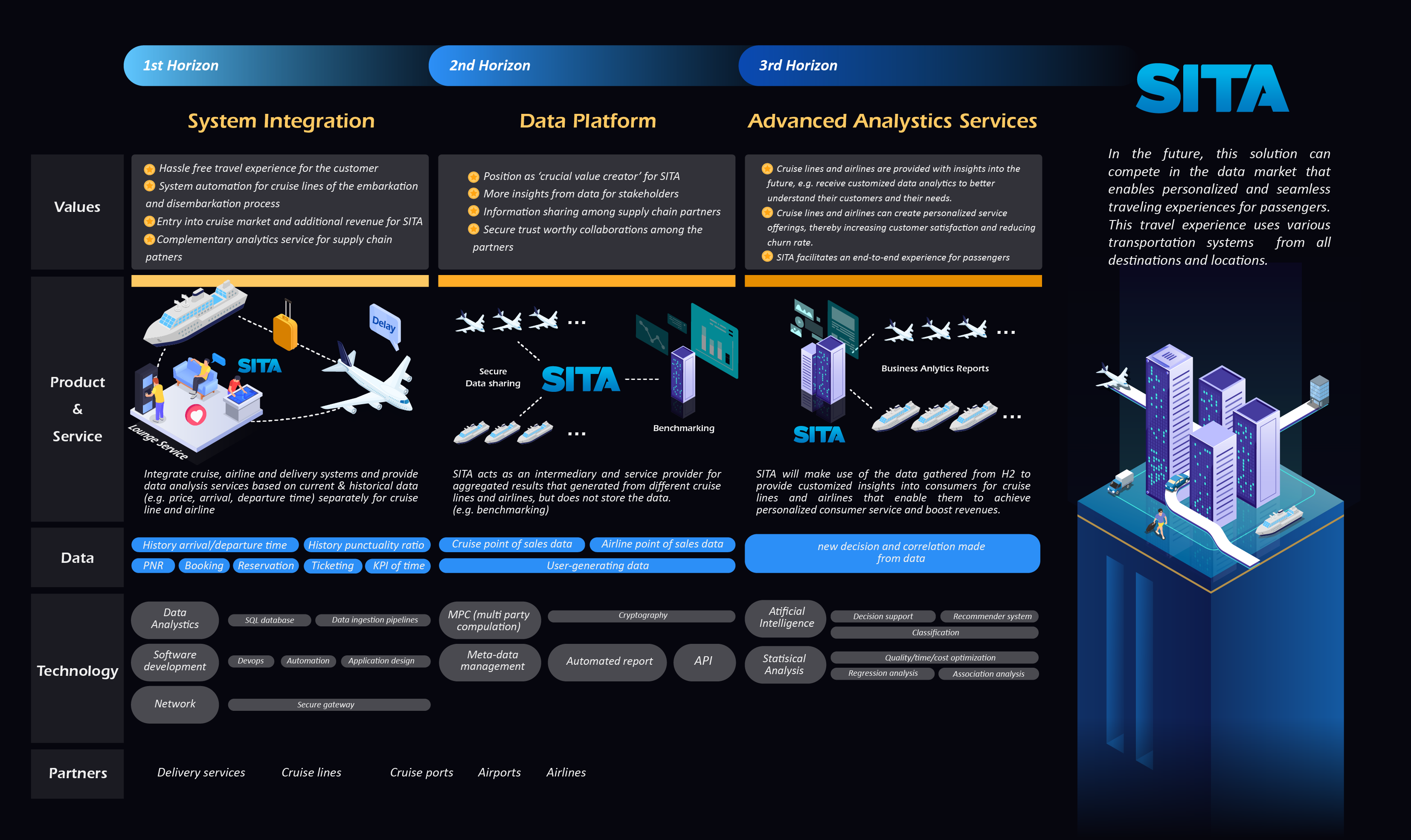

services have a huge impact on passengers’ satisfaction. On top of that, SITA wants to extend its business by including the cruise line

market in the customer journey ( see the elaborated version of SITA’s market here). The goal is to provide an effortless, secure, and cost-efficient

baggage transfer experience for passengers in-between different destinations such as cruise ports,

airports, and other locations like passengers’ homes and hotels. This project aims to provide

a solution to achieve this goal and create a business model including its implications for SITA.

Location

In this project, the geographic scope is limited to the Netherlands.

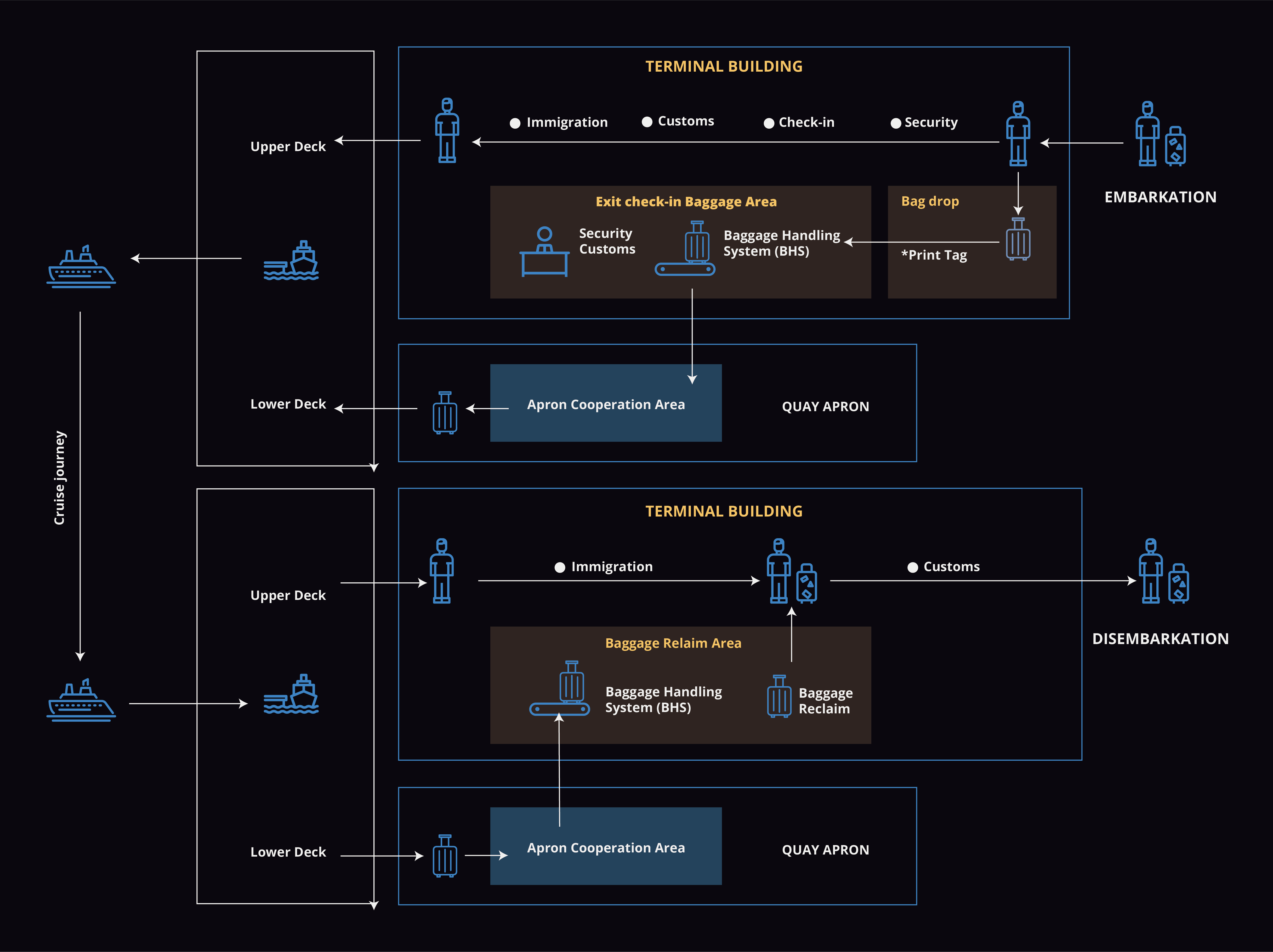

Process

In this project, we only focused on the journey between the cruise ports and

airports

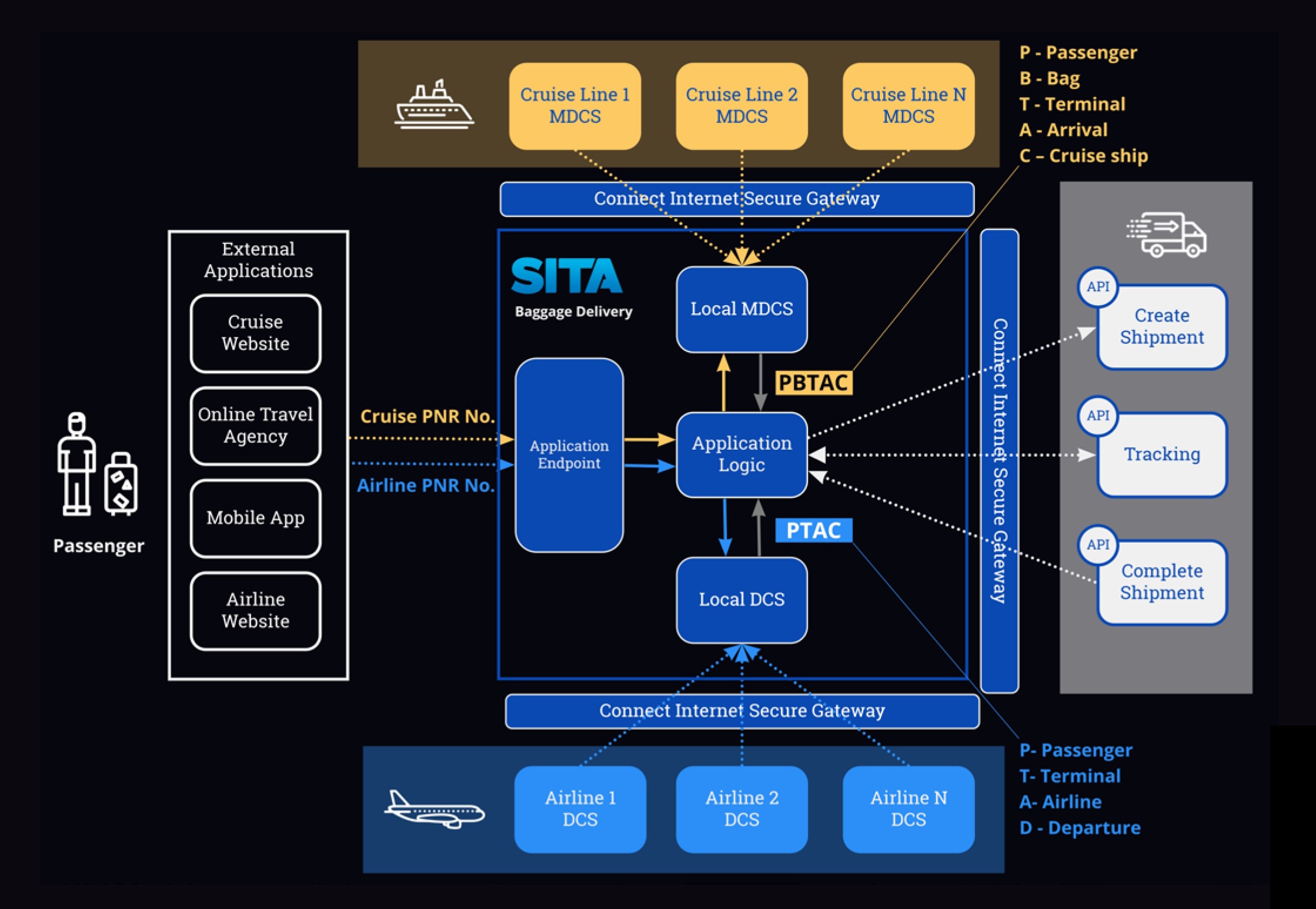

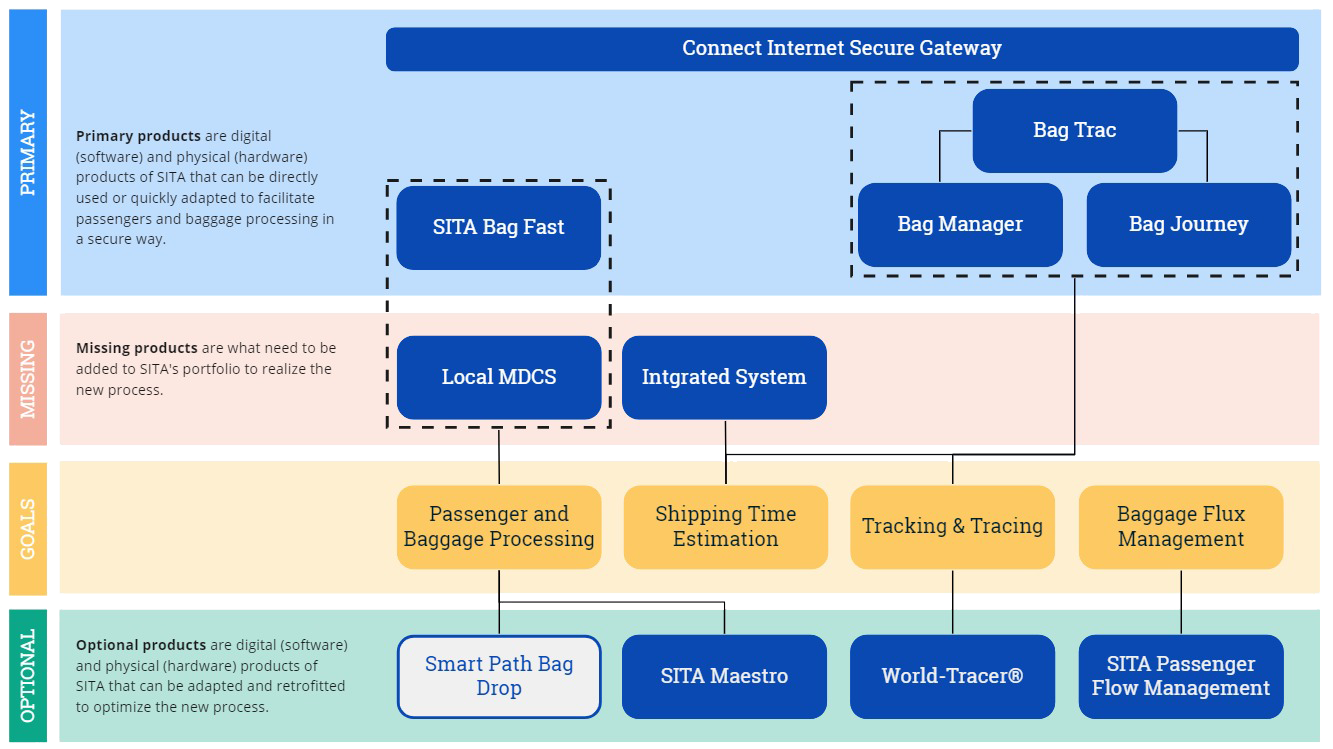

System

In this project, we would mainly focus on the software systems

Scalability

In this project, we should also consider how to implement the solution on an

international scale regardless the geographic scope.

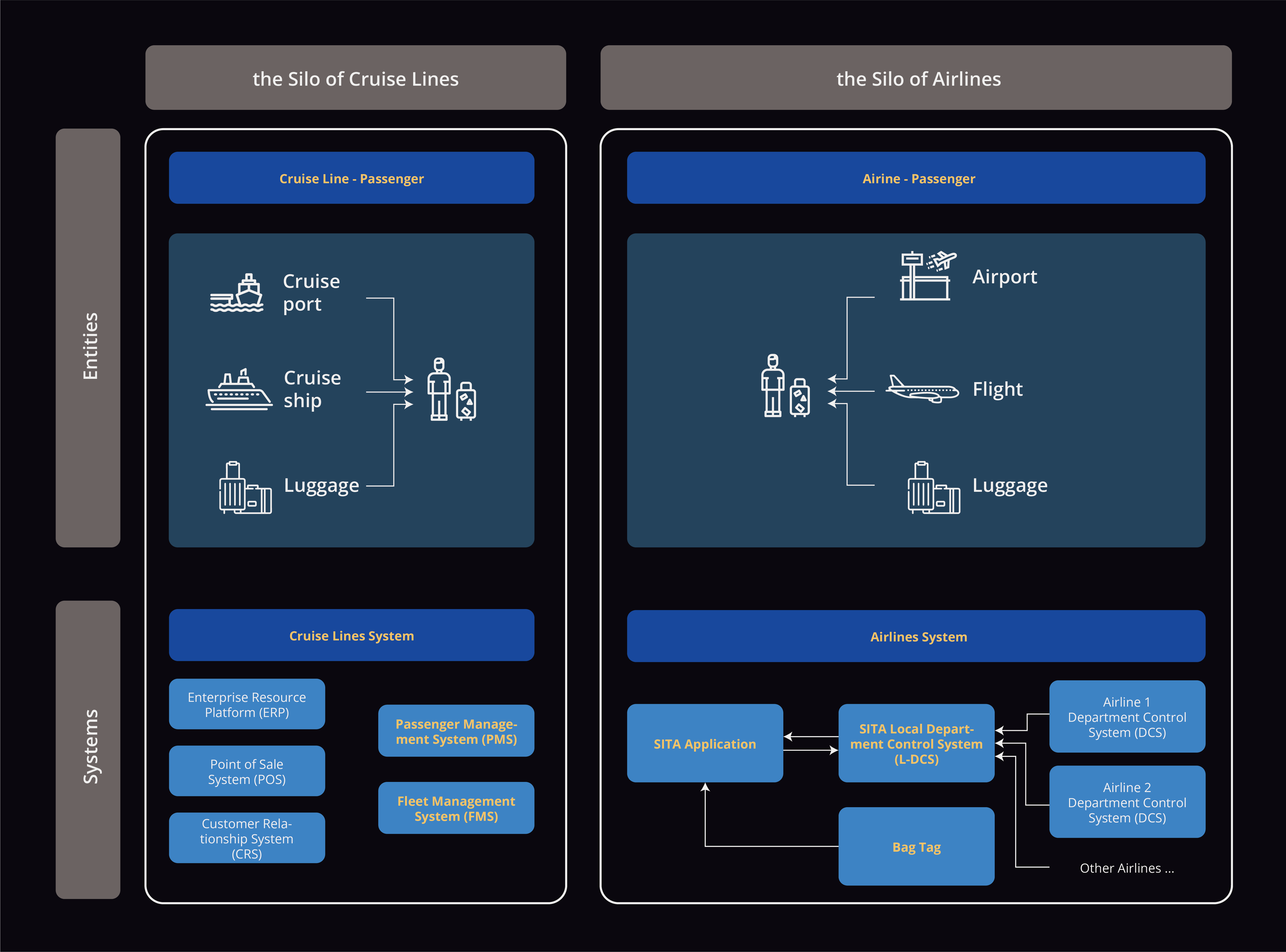

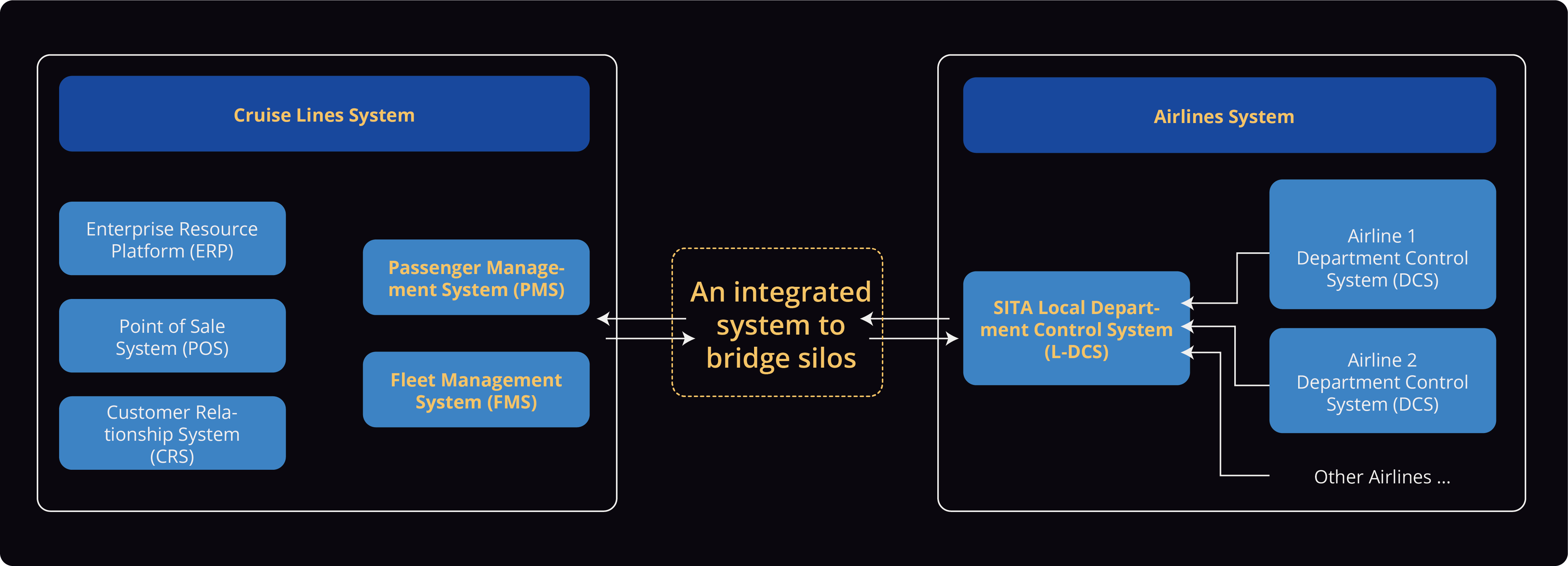

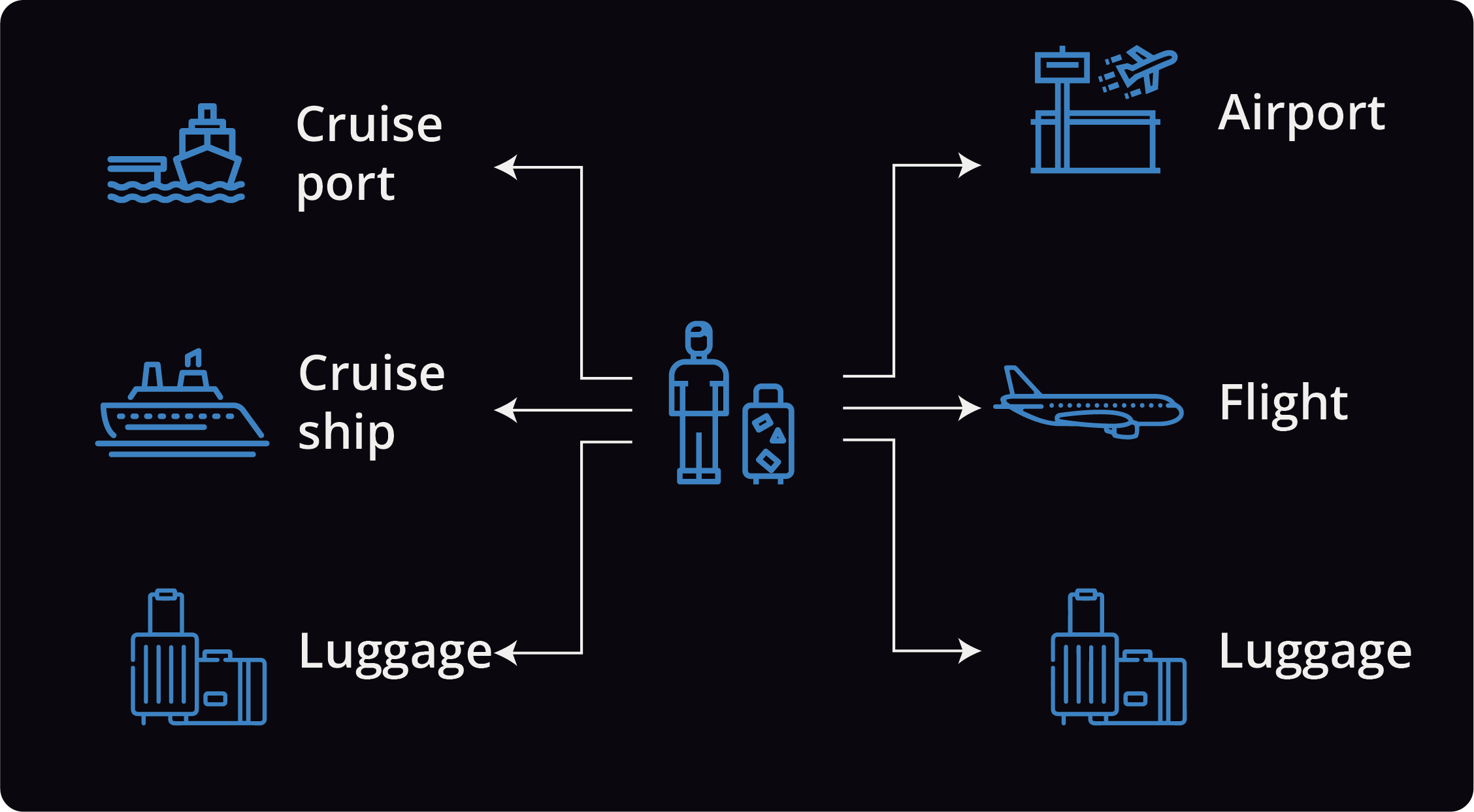

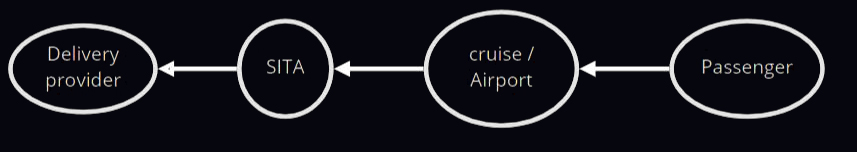

position

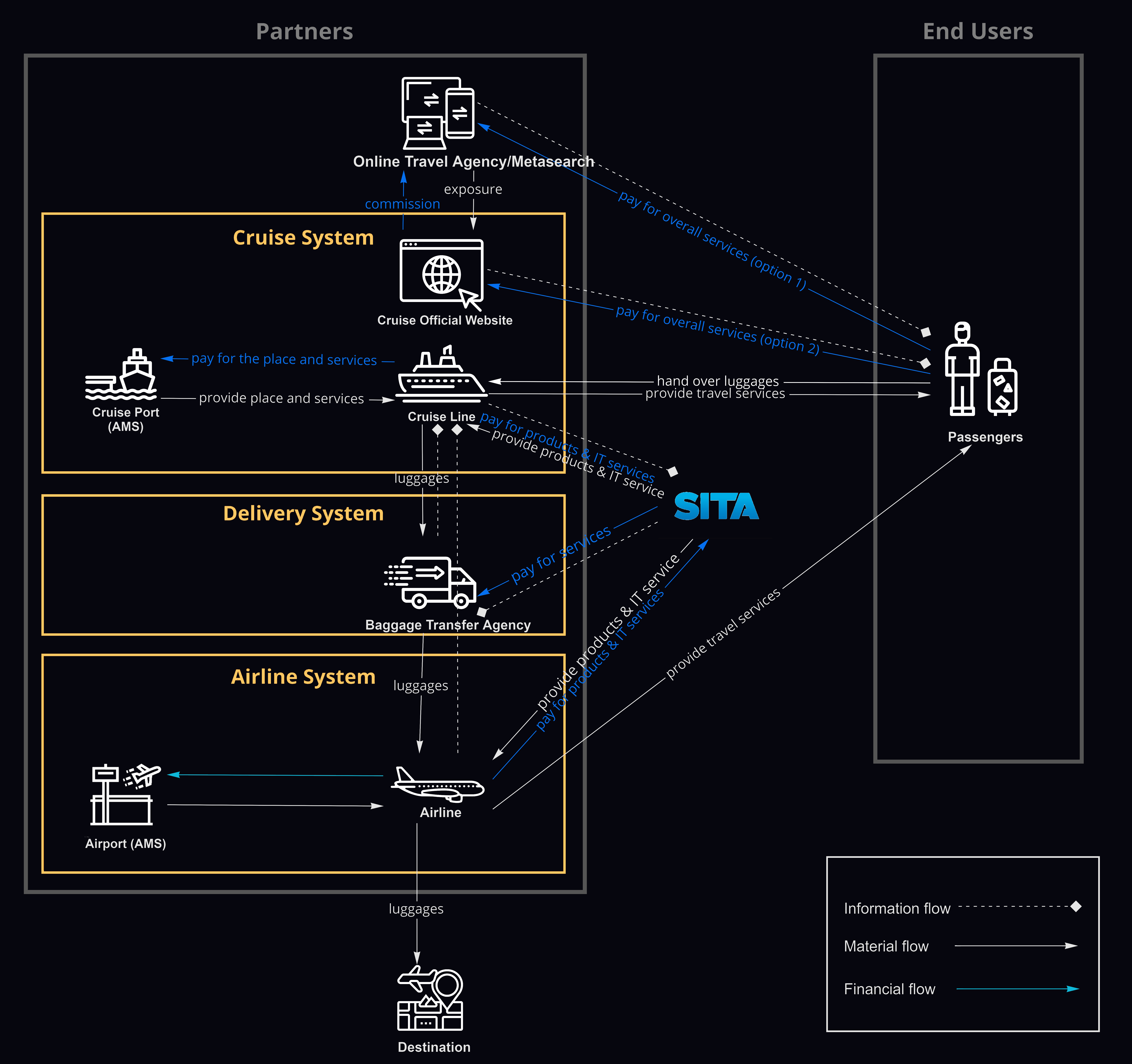

Where is SITA located in the whole system

To understand SITA and its environment better, we conducted stakeholder analysis and TOWS

analysis. A basic understanding of stakeholder dynamics is

needed to develop a suitable solution that

satisfies as many stakeholders as possible. Therefore, the complete system has been

summarized in a map

showing how the different actors are intertwined.

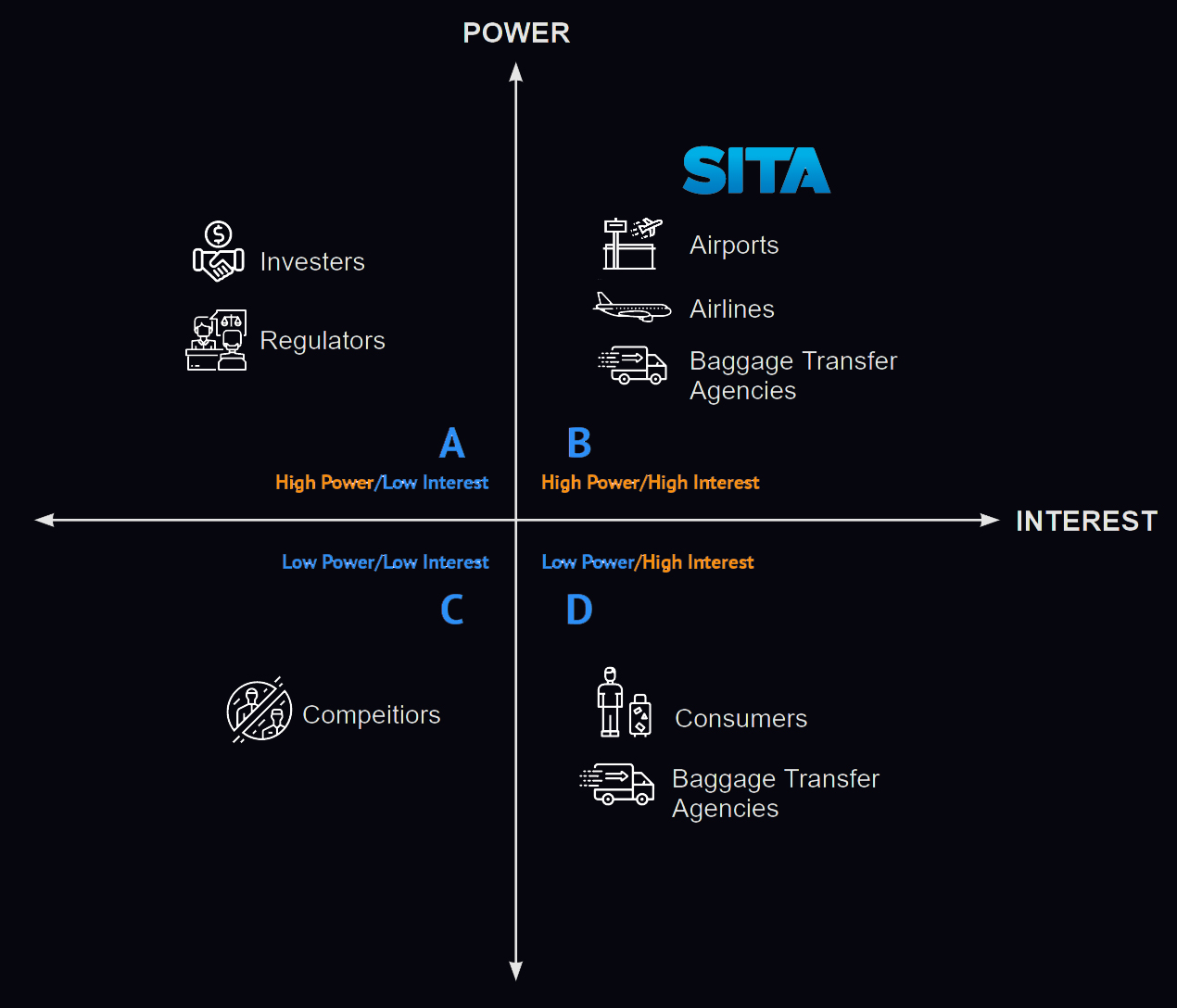

Stakeholder analysis

A stakeholder analysis was conducted to map out various relevant actors and understand them

better. Relative stakeholders are plotted in a power/interest grid. Two things are noteworthy here.

Firstly, transfer agencies are added to the grid twice. The one in quadrant B is a

one-to-one

relationship with SITA, which means there is a single big company with which SITA has a partnership. The

one in quadrant D is a one-to-many relationship, which means multiple smaller transfer agencies are in

contract with SITA. The pros and cons of these relationships will be discussed later in the supplier

relationship.

Secondly, consumers (quadrant D) are the end-users of all stakeholders in quadrant B except for SITA.

All actors ultimately will try to provide value for their end-users to gain long-term benefits

themselves. SITA’s main customers/clients are mainly toB (e.g. airlines) and these clients have the

customers whom they provide services for.

A full list of stakeholders

System map

The different stakeholders and their connections have been visualized to better understand the whole

system and the dynamics.

market analysis

The prospects for the cruise industry are optimistic

A detailed analysis of the cruise ship market is shown here, from which the following key

insights were yielded:

The global cruise ship market is dominated by three key parent companies which

include Carnival, Royal Caribbean International (RCI), and Norwegian. Carnival possesses the highest

market share at 37.1 %. Other smaller cruise lines possess a significant market share of 29.2%.

The number of passengers grew by almost 60% between 2009 and 2019, until the

pandemic resulted in a steep drop. The prospects for the cruise industry, however, seem optimistic as

the economies emerge out of the pandemic, which can be validated by the two-fold increase in the number

of passengers between 2020 and 2021.

Europe is the second largest passenger source with 3.5 million passengers. The

passenger source can be further drilled down to Germany: 1,068,900, France: 374,100, and Benelux:

97,900.

Most cruises in Amsterdam port operate between May and October representing a

predictable seasonal trend.

The market data we based on

TOWS Analysis

Know yourself

A TOWS analysis, or SWOT, involves identifying an organization's strengths, weaknesses,

opportunities, and threats. On top of that, it will combine internal and external aspects to identify

appropriate strategic choices that an organization may follow. It may help a firm identify

opportunities, reduce threats, overcome weaknesses, and maximize strengths (TOWS, n.d.).

Three critical

strategies can be externalized from the TOWS analysis.

Firstly, SITA should use existing capabilities to innovate

and optimize the cruise port to airport delivery. Since SITA already has years of experience with

airport luggage handling, similar systems can be used for cruise lines.

Secondly, the pandemic can be used to set up/negotiate new

systems which will provide more value to passengers. Brand reputation and business expertise can be

used to leverage the position of SITA.

Lastly, establishing innovation labs/skunkworks to enable

creative and fast development. SITA will operate faster in the new industry as an incumbent company.

The complete TOWS analysis

Porter's five forces

Know the enemy

Entering a new market is a strategic decision that requires a good understanding of the

competitive landscape. While there are currently no direct competitors in the market of interest, the

dynamics of the competition can be identified in the underlying economics of the industry (Michael &

Porter, 1979). Porter’s framework analyses different competitive forces.

Threat of new entrants

The market under consideration has high

barriers to entry.This can be attributed to three primary reasons: capital investment

needed for development, process complexity, and the involved network of stakeholders. Given

SITA's financial strength, experience in baggage management, and existing partnerships with

airports and airlines, SITA can leverage this to its advantage.

Power of Suppliers

In this research, baggage transfer

agencies are considered the supplier of interest. SITA must establish a balanced

power relationship with its supplier. Furthermore, to ensure a sustainable relationship that

allows for interaction between the people and systems, a strong emphasis must be laid on co-creation.

Power of Customers

Buyer-seller relationships are often driven by resource utility and market

scarcity and can be controlled through coercive (punishment) and non-coercive (assistance)

practices (Rehme et al., 2016). To maintain a power

balance and positive relationship with buyers (both cruise lines and cruise passengers),

SITA should focus on non-coercive practices. Distinctive product offerings and complimentary

services can achieve this.

Threat of substitutes

Forward integration by delivery service

suppliers and luggage shipping agencies like Eelway, Sendmybag, and Yamato transport can be

recognized as significant threats. A service differentiation strategy (based on both

technology and partnerships) can be used to develop and maintain a competitive advantage.

The complete Porter's Fice Forces analysis

Supplier Relations

Build strategic collaborative relationships with suppliers

The baggage must be physically transported from the cruise ship terminal to the airport

terminal. Considering SITA’s core competencies and the

company's strategic vision, baggage transportation must be outsourced. Given this, baggage

delivery service providers are the main suppliers in this research. The possible relationships are

analyzed by using the Karlijk matrix, which serves as a framework for analyzing modern purchasing

(Kraljic, 1983). Two feasible relationships were analyzed:

Routine

Transactional

Relationships:

The product or service is easily available in a routine transactional relationship. In such a

relationship, the actors are not deeply invested in each other, and the switching cost is low.

Therefore the purchasing risk is low. SITA may work with several delivery service providers to

arrange ad-hoc services in the given context.

Strategic

collaborative

relationships:

The buyer and supplier develop a partnership built on long-term contracts, fair agreements, and

collaborative support. While the risks involved are high, they are often shared, and strategic

interfirm collaboration results in higher responsiveness and superior performance of the supply

network (Kim & Lee, 2010). Strategic collaboration also facilitates inter-system communication

between SITA systems and delivery service providers. This can be instrumental in ensuring bags are

tracked, traced, and accounted for during the transfer process.

The analysis shows that the benefits of a strategic collaborative relationship outweigh

the routine transaction relationship in this case. Further insights from market data emphasize a

predictable passenger influx that does not require an ad-hoc service. Therefore, we recommend strategic collaboration as the preferred

relationship model between SITA and the delivery service providers, which fosters reliability,

resilience, and service excellence.

User research

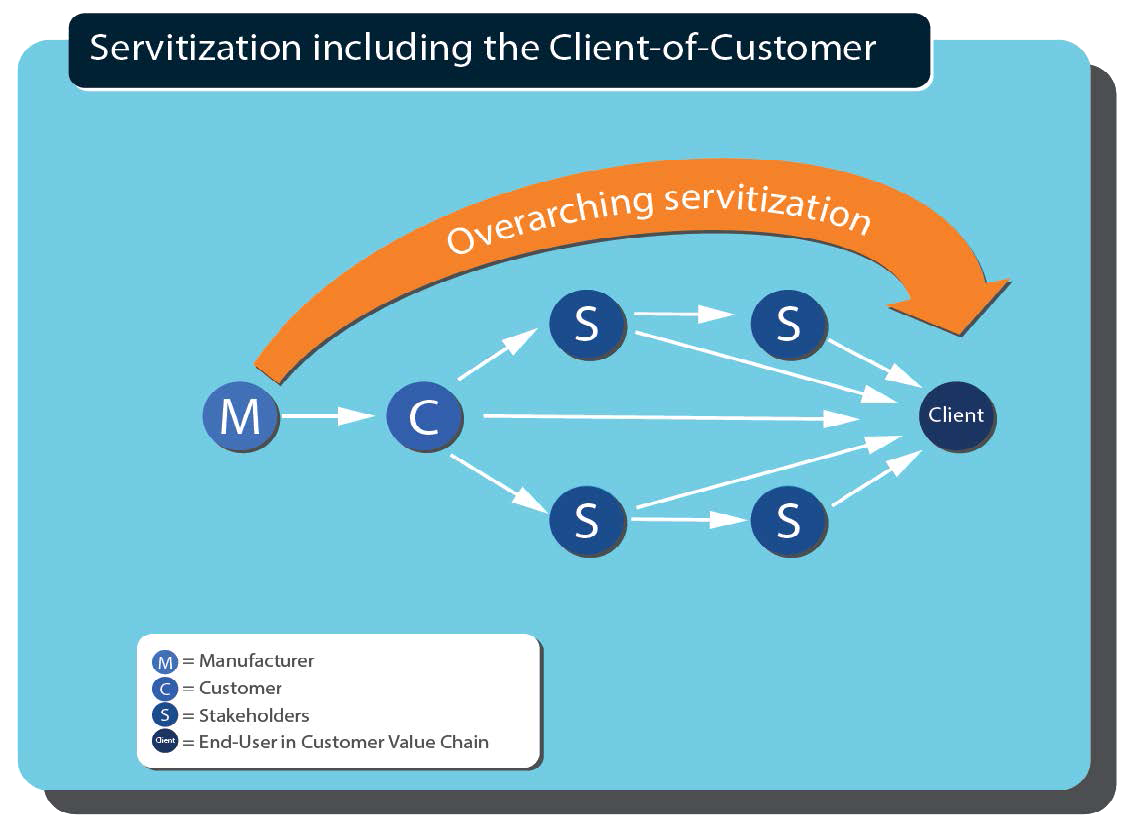

Achieve overarched servitization in the B2B industry by knowing your end-users

SITA is a B2B-driven organisation. Logically, they investigate the interest and needs of

their direct customers, such as airlines and airports. However, this would neglect a stakeholder, which

is not significant at first glance with its low power and high interest, namely, consumers. Consumers,

also known as cruise and airline passengers, are end-users. SITA’s direct customers do not only try to generate value for

themselves in terms of reducing overhead cost but also try to improve

passengers’ experience to improve consumers' loyalty and gain additional income streams. For

this reason, we conducted deep user research to gain more insights about the end-users and their pain

points.

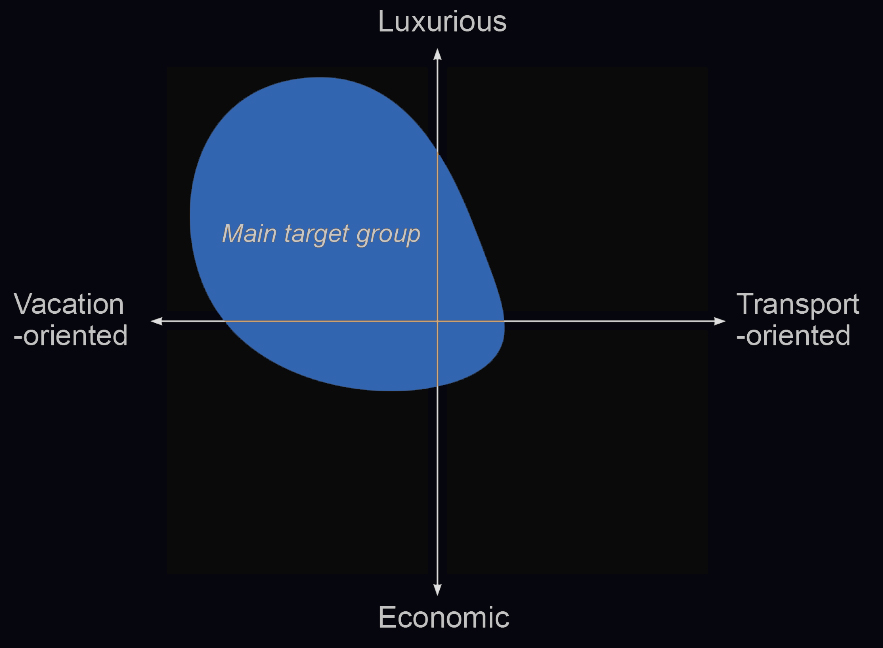

Segment: Luxurious and travel-oriented

The four primary categories of market segmentation are demographic, psychographic,

behavioral, and geographic segmentation. However, one can apply many additional tactics, including

variants of the four main types (LOTAME, 2019). To come up with the different customer types and better

scope our consumers, some desk research on cruise line consumers was conducted. Afterward, people who

recently have been on a cruise trip were interviewed.

More information about interviews

Customer segmentation

More information about segments

The desk research and interviews resulted in a behavioral and partly demographic

segmentation. Since the project's scope is within the Netherlands, the segmentation is

geographic to a certain level by default. The matrix exists out of 4 quadrants and is divided by

luxurious and economic on the Y-axis and vacation-oriented and transport-oriented on the X-axis.

Luggage-free transport appeals to the luxurious

quadrants. Also, vacation-oriented travel is more popular than transport-oriented travel,

which is concluded by the interviews. Therefore, the target group of the solution for

this project will be in Quadrant A (left-top). In order to gain more empathy with the consumers,

we created different personas

representing the target group.

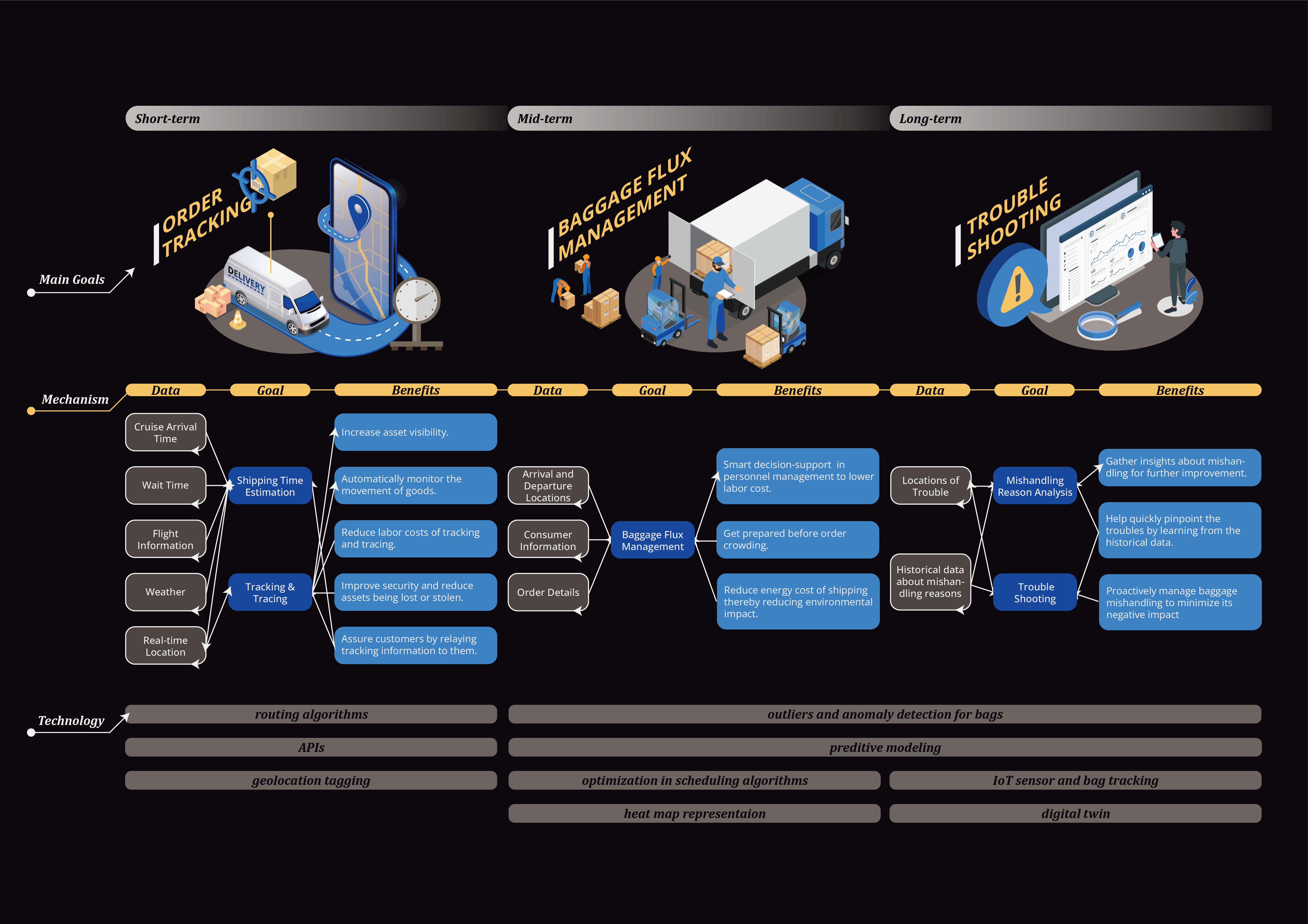

Customer journey map

To better identify the design opportunities along with the whole user journey, we mapped out

the complete user journey and brainstormed different ‘if’ scenarios to help us complete the user

stories. We also considered the assumptions we based on that need to be checked later and the related

regulations.

the 'if' scenarios mapping

The complete user journey

maps can be seen here. Here are the main insights:

Luggage on the cruise ship can differ at the end than from

the beginning. Therefore, there should be a control point on both sides.

Luggage destination can change. There should be clear

deadlines for changing luggage which should be communicated with the pickup service.

Luggage should be traceable for the consumer. In other words,

the process should be transparent.

Consumers should get notifications of important information

such as luggage delays, if luggage reached the destination, or if the pickup service is on its way.

The technology should be easy to use, and there should be

assistance available when the consumer is in need.

Selecting the luggage service should be togglable, and the

service itself should be easy to understand, including payments.

Interesting consumer pain points are below:

Consumers do not keep track of the weight of bought goods on

the cruise. Therefore, luggage weight can differ.

Consumers' agendas can change, especially when tickets are

booked way in advance. Life happens, and last-minute things can occur, which can cause a delay in

the luggage handling process.

It’s a new process that should be clear for consumers without

reading too much or doing much external stuff.

Consumers might bring higher quantities of luggage now that

they do not need to carry it anymore.

Consumers with kids want to use the service as a stress

reliever. So, it shouldn’t give them extra steps.